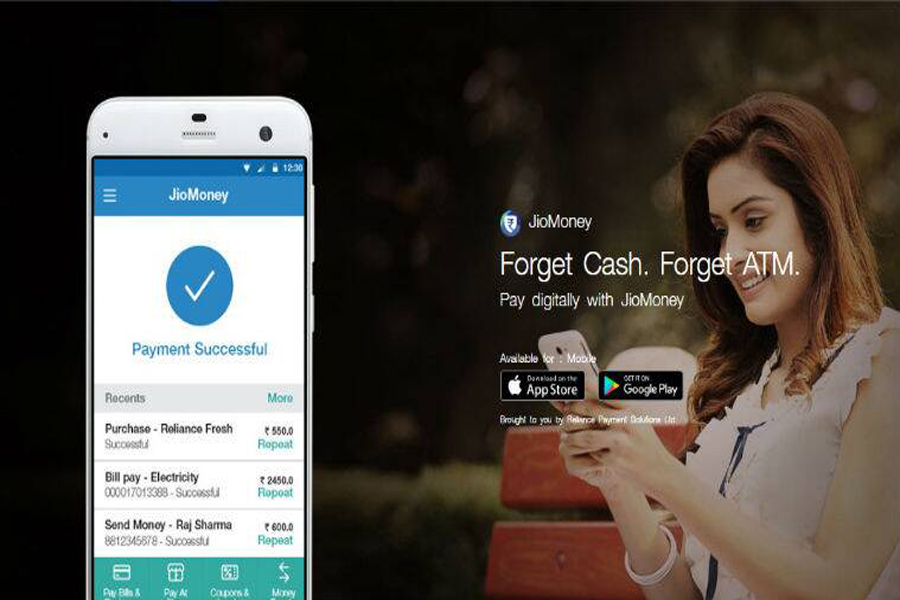

With the dream of making a Digital India of Prime Minister Narendra Modi slowly moving towards its success, now it is touching new heights. For this reason, a record 25.5 billion online payments or transactions were done in India in the year 2020. Which is far ahead of China’s total of $ 15.5 billion. India has achieved this progress due to the ease of UPI payments. Along with this, mobile wallets and digital payment apps of many companies are contributing to this. But many payment apps give the option of online transactions to the users but they are not user-friendly for all. Due to which it becomes very difficult to decide which platform will be right.

We have brought a solution to this problem and which digital payment app is right for you.

PayZapp

In line with the changing banking scenario and to meet the expectations of the customers, HDFC Bank launched its e-Wallet facility in the year 2015. Payzapp is an e-wallet launched by HDFC Bank in the year 2015. The app is powered by Visa and Mastercard. Customers can link HDFC Bank as well as any other bank debit or credit cards with their PayZap application to enjoy the unlimited benefits offered by this e-wallet.

PayZapp’s many features include transactions with other PayZapp wallets or other bank accounts, travel or movie bookings, dinner bookings, cashback, discounts, rewards, easy recharge of mobile and DTH plans, and much more. PayZapp has various modes to offer its customers multiple rewards through cashback, discount offers, reward points which can be redeemed with partner merchants, sign-on bonus, es and much more.

Freecharge

FreeCharge, a wholly-owned subsidiary of Axis Bank Limited, used to be India’s No. 1 payment app. Customers across the country use FreeCharge to make prepaid, postpaid, DTH, metro recharge, and utility bill payments for multiple service providers. E-Wallet was launched in September 2015 and customers are using it to pay money across all major online platforms and offline stores.

The mission is to make millions of merchants a part of the digital payments ecosystem, both in the organized and unorganized sectors. FreeCharge’s Chat-n-Pay service is all about social payments. It is an attractive and secure way for users to seamlessly chat-n-pay to friends, family, and merchants in less than 5 seconds. It enables small or large merchants to accept digital transactions in less than 1 minute immediately after registering on the FreeCharge App.

Airtel Payments Bank

It was launched by India’s largest telecom provider company Bharti Airtel in January 2017, to support the cashless revolution promised by the Government of India.

Airtel Payments Bank is a one-of-a-kind bank that provides essential financial services to its customers. To meet the needs of the under-served and unbanked population in the country, their products have been created as a solution to the problems posed by traditional banking from long queues to endless documentation to inconvenient travel. It aims to make banking simpler, more convenient, and more intuitive.

JioMoney

JioMoney is a safe and secure way to make digital payments on physical and online channels. Users can make instant bill payments, mobile/DTH recharges, pay at thousands of online and physical stores, and much more. Users can also link their card and bank accounts with JioMoney.

JioMoney allows the registered user to make secure cash-free transactions from anywhere at any time, securely store all credit/debit cards and bank accounts for convenient and fast transactions, and directly to other JioMoney users Transfers money to the bank accounts of others.

PhonePe

Next on the list of leading online payment apps in India is PhonePe. PhonePe was launched in 2015 and in just 4 years it has been able to cross the 100 million download mark. From UPI payments to recharges, money transfers to pay bills online, you can do it all on PhonePe. It has a very nice user interface and is one of the safest and fastest online payment experiences in India.

You get many benefits like transacting directly from your bank account, for which only a mobile number is required. PhonePe users can also automate payment of bills and locate nearby services and outlets for food, healthcare, and other utilities. It allows the linking of multiple bank accounts to do UPI transactions.

Amazon Pay

Amazon Pay is a service that allows users to use payment methods already linked to their Amazon account to pay for goods, services, and charities on third-party websites, in apps, and using Alexa. To pay, users can use any payment method on file in their Amazon account.

There are no charges for transactions with the merchant using Amazon Pay. There are no transaction fees, no subscription fees, no currency conversion fees, no foreign transaction fees, and no other fees for purchases. It offers multiple payment options like gift cards, Amazon Pay balance, credit cards, etc., and gives back cashback and coupons for discounts on every transaction.

Google Pay

Google Pay is the easiest way to send money to your friends or family, pay or recharge your mobile bill, pay the neighborhood chaiwala/coffee shop. Send or receive money with zero fees, directly from users’ bank accounts to almost anyone. Google Pay Users can receive money or send money even if their contact number is not on Google Pay. Users can recharge their mobiles number with only one tap and pay those monthly bills on Google Pay.

They have covered their users with easy access to past transactions so that they are always in control. It comes with the highest security that Google offers in its other applications as well, so the user does not have to worry about their money being insecure. Google Pay can be used wherever we see a UPI QR code or Google Pay tag.

Paytm

Paytm is India’s leading digital payments app company providing full-stack payment and financial solutions to consumers, offline merchants, and online platforms. The company is on a path to bring Indians into the mainstream economy through payments, commerce, banking, investment, and financial services. Paytm is owned by One97 Communications Limited, owned by Vijay Shekhar Sharma, and headquartered in Noida, Uttar Pradesh.

Its investors include Discovery Capital, T Rowe Price, Berkshire Hathaway, SAIF Partners, AGH Holdings, Ant Financial, and SoftBank. Apart from carrying out e-commerce transactions, this e-wallet app can also be used to make bill payments, transfer money, and avail services from merchants from the travel, entertainment, and retail industries. They now have UPI-enabled payments as well.